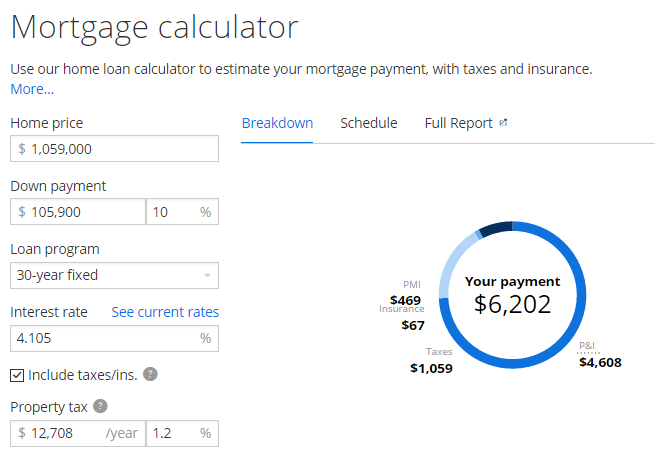

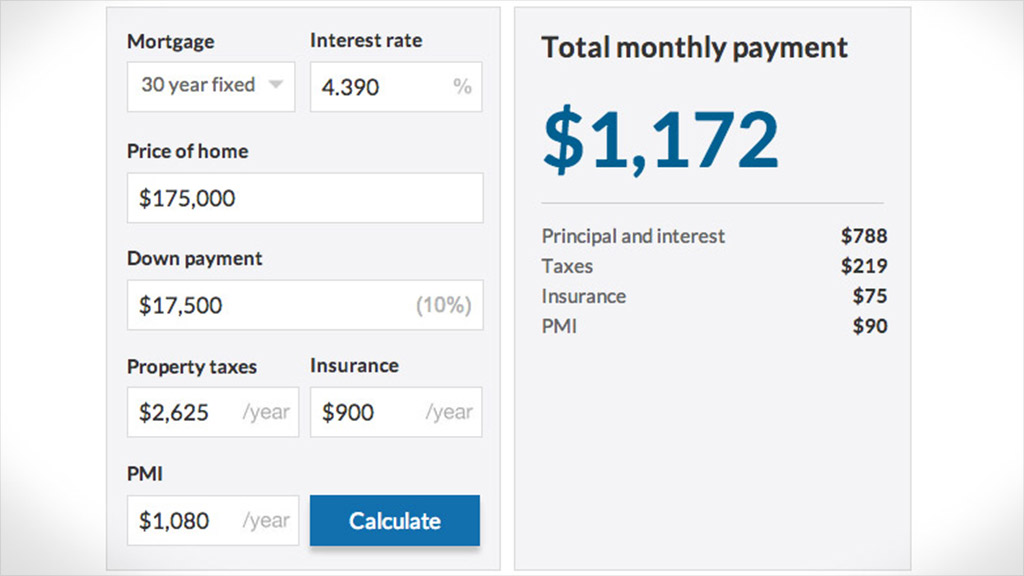

Property taxes are used to fund public services. Property tax: Taxes collected by local and state authorities based on a property’s assessment and local tax rates.The monthly MIP amount is based on your loan terms and down payment, but you can expect to pay 0.80% or slightly more annually on a 30-year loan. Homebuyers pay an upfront FHA mortgage insurance premium (MIP), currently 1.75% of the base loan amount, and an annual MIP that is included in your monthly mortgage payment.

FHA mortgage insurance: Premiums the FHA charges the borrower to protect the FHA-approved lender if the borrower defaults on mortgage payments.Principal and interest usually comprise the central portion of a borrower’s monthly payment. Interest is what the lender charges the borrower for the loan. Principal and interest: The principal is the money the homebuyer borrows from the lender and needs to pay back.But FHA loans require a down payment of just 3.5%. Typical down payments range from around 5% to 20% of a home’s purchase price. Down payment: The sum of money that a buyer pays upfront for a home.A loan term can be subject to change if a borrower pays off a loan early or chooses to refinance a loan.

This is typically 15 or 30 years for an FHA loan.

The resulting tax savings is accounted for in each item’s totals. Property taxes, the interest part of the mortgage payment and, in some cases, a portion of the common charges are tax deductible. These include mortgage payments, condo fees (or other community living fees), maintenance and renovation costs, property taxes and homeowner’s insurance. Recurring costs are expenses you will have to pay monthly or yearly in owning your home. This includes the down payment and other fees. Initial costs are the costs you incur when you go to the closing for the home you are purchasing.

0 kommentar(er)

0 kommentar(er)